|

Many skilled and experienced professionals are finding themselves on their own, seeking employment for the first time after being forced to abandon the safety of an organization that regularly delivered their paycheck each month. As a result, an increasing number of professionals are rethinking their employment strategy. Cash flow, health insurance, and retirement dominate this strategy. For seasoned veterans, there are also growing concerns over job satisfaction, location, and stress. Let’s say that you are considering the decision to incorporate. There are seductive attractions to being an independent contractor: being your own boss, having flexible hours, and seeing the family whenever you like. But before making a final determination to start a construction business, there are some things that need to be considered: Do you have the necessary qualifications to start a construction business? Having a few years of on-site experience in construction is extremely important. Do you possess any business training? Do you know anything about running a business? Starting a construction business from scratch is costly. You need to know how much it will cost to get the business up and running, and a sound business plan is crucial. Starting a construction business is not a 9 to 5 job. It will need someone who is willing to spend 12 to 15 hours a day to get the business off the ground. Do research to ensure that the city where you live is not inundated with this type of business. Discuss with others in the trade the potential for success of a construction business in your area. Try to determine if there is enough work to support your new company or if there is a niche that you can fill. Make your dream of starting a construction company come true by doing adequate research and being prepared. |

|||

| Copyright © 2009 by The McGraw-Hill Companies, Inc. Click here for terms of use. | 281 | ||

| 282 | Chapter 12 | ||

| 12.2 PREPARING A BUSINESS STRATEGY AND PLAN | |||

|

Planning is the key to success in any business. The importance of planning cannot be overemphasized. It may take two or three weeks to complete a good plan. Most of that time is spent in research and reevaluating your ideas and assumptions. Taking an objective look at the business plan will identify areas of weakness and strength, pinpoint needs that might otherwise be overlooked, and spot opportunities early. It provides a road map to make sure you are going where you want to go to achieve your business objectives. A business plan is an operating tool, which, when properly used, can help manage the business and work effectively toward its success. Moreover, lenders require one. A well-written business plan communicates ideas to others and provides the basis for a financial proposal. It will also determine the feasibility of a project and lay out the action necessary to complete it. A good plan can help convince a bank or potential investor that you are worthy of assistance in funding this new venture. The plan itself may not get you funding, since it is very difficult to find capital for startup businesses. As the business owner, you are expected to have sufficient startup capital from your savings or from a bank loan based on income other than the business. Putting a successful business plan together is both an art and a science. While there are a number of ways to format a business plan, the following outline presents key elements to consider in developing your business plan: Executive Summary The executive summary provides an overview of the business plan and should not exceed two pages. Even though it will be at the beginning of the plan, it should be written after the rest of the plan is completed. It brings together the significant points of the project and should convey enthusiasm and professionalism. Typically, investors will not spend more than a few minutes to review a business plan to determine whether they should read it in detail or go on to another plan. It is therefore essential to prepare an appealing, convincing executive summary to capture the investor’s attention and imagination and to make him or her more likely to read the remainder of the plan. It should be concise yet comprehensive and outline the fundamentals of the company, how it came into existence, and the people linked to it. If the business plan is part of a loan application, state clearly how much you want, precisely how it is going to be used, and how the money will increase the business’s profits, thereby ensuring repayment. In essence, the executive summary is the most important part of the business plan, as it will dictate whether or not the remaining pages are read. Company Description, Vision, and Mission In any organizational venture, the first step is to develop a realistic vision for the business. This vision typically reflects an overall picture of the business as you see it in three or more years’ time in terms of its likely physical form, size, activities, etc. Describe the company strengths and core competencies and the factors needed to make the company succeed. This should be followed by the company’s stated mission. A mission statement should concisely reflect the direction of the company’s business, its goals, and its expected achievements. Define both the key short-term and long-term goals and objectives and which factors are to be focused on in the short term and which in the long term. The com- |

|||

| Construction Business Environment | 283 | ||

|

pany description should also indicate the structure of the company (sole proprietorship, partnership, corporation, etc.). Management Even if you are a one-person operation, a key ingredient of your potential business success is the strength of your management skills. When the business consists of more than one person, the business plan should identify the people who will be active in this business and include a short biography of principals and senior personnel as well as their backgrounds, positions, responsibilities, and strengths they bring to this new venture. Market and Services Offered Describe in depth the services offered, the market for your service, how you fit into that market, and your plans for achieving your share of the market. State the factors that give your firm a competitive advantage over others in this field. Examples may include level of quality or special skills or experience. Outline the pricing or fee structure of the services offered. Include any photos or sales brochures in an appendix. The Successful Business Plan A business plan is basically a written document that describes the business, its objectives, its strategies, its market, and its financial forecasts. Explain the type of company and services to be provided. If this is an existing business, give its history. If it is a new business, describe the product and/or service and note some of the qualifications to start this business. Also explain why this business is needed and what its chance for success is. Describe any unique features that will attract customers to this business. An effective plan must outline the marketing strategy that is to be implemented. A business plan is thus a useful operating tool, which, if properly used, will help manage the business and facilitate its success. Although a business plan serves many functions from securing external funding to measuring success within the business, its main purpose is twofold: First, it helps ensure that you have researched and thought out the various aspects of running the business so you don’t encounter any sudden unpleasant surprises. Second, lenders require it, and it can help convince banks or potential investors that your firm is worthy of receiving financial assistance. The concept here is to communicate ideas to others while providing the basis for a financial proposal. Setting up a business is rarely easy; statistics show that over half of all new businesses fail within the first 10 years. The reason for such failure is often due to lack of planning and lack of funding. The best way to enhance the chances of success is to plan and follow through on that plan. Financial Plan This section of your business plan is critical. The credibility of your projections is essential to establishing the likelihood of success or failure for your business. Investors and lenders will use the information in this section to evaluate the financial prospects of your business. Be sure to check how many years of financial projections your lender requires—three years is the norm. State the business’ financial requirements |

|||

| 284 | Chapter 12 | ||

|

and how these funds will derive from project revenues, costs, and profits. Developing financial statements assists in understanding the cash flow of a business, its break-even point, and the sensitivity of the business to fluctuations in product costs and market factors. The financial plan would ideally consist of: a 12-month profit and loss projection three- to five-year profit and loss projection (optional) one-year month-by-month cash-flow projection projected balance sheet break-even point personal financial statement of owner Together they constitute a reasonable portrayal of your company’s financial potential. In all cases, it is strongly advised to consider seeking legal counsel to be sure the plan and business venture are legal and meet your requirements. In addition, the service of an experienced accountant is important. Unless you are prepared to construct spreadsheets and graphs explaining how you intend to use your money and your projections for the future, you might want to hire someone who knows all the financial ins and outs of a business. Factors for Success There are many factors that will impact the chances of a new company’s success. They all require devoting considerable effort in personal networking with attorney groups and other potential clients in your area. Some of these factors include: 1. Extensive network: A single contact may yield a lucrative contract, but it takes a strong network to yield a continuing stream of work. 2. Excellent communication skills: Most executive-level professionals have excellent verbal skills, and this ability is one of the primary determinants for achieving success. Writing skills are an entirely different matter and can be a major challenge to those who largely depend on others to put pen to paper. 3. People skills: Fundamental to any successful business is relating effectively to others—clients, employees, suppliers, and consultants. Successful businesspeople invest in developing their communication and interpersonal skills. 4. Hard work: In private practice there is some flexibility in work hours, but this is no eight-to-five job, and hard, focused work and effort are needed to build the practice. 5. Self-direction: Some people have great difficulty in working on their own initiative and need a structured environment to perform. Independence can be freeing, but it can also be lonely; some people require daily, face-to-face interaction. This is especially true of individuals, who work out of their home office instead of renting space in a corporate office park. 6. Marketing skills: Some people are shy and introverted, but if you are not willing to engage in relentless self-promotion, you may not be able to bring in sufficient new business to succeed. Identify your target market. There should be specific target markets that will need your services and be willing to pay for it. Outline a marketing strategy with a competitive edge that draws customers to you and your company rather than the competition. Clients can come from a number |

|||

| Construction Business Environment | 285 | ||

| of different, unanticipated directions. You have to be flexible and be able to adapt to emerging situations. 7. Financial security: Owning your own business is one of the better ways to gain wealth, provided you know what is required. Starting a business is risky, but the chances of success are better if you understand the challenges you will meet and resolve them before you start. Likewise, it is essential that the new startup have a financial capability to survive the dry periods, which could easily last a year or more; otherwise it may be prudent to reconsider the decision to be an independent contractor. In addition to the various bureaucratic and legal hurdles that an entrepreneur must overcome to incorporate and register a new firm, there are procedures as well as time and cost involved in launching a contracting firm. These need to be examined before attempting to launch such a venture. 12.3 STARTUP COSTS AND CAPITALIZATION |

|||

|

Start-up expenses can basically be segregated into: 1. investigatory, and 2. pre-opening costs. These costs can be incurred over a period of several weeks or several years, depending upon the type of industry under consideration and the length of the search process. Start-up costs would normally include any amounts paid or incurred in connection with 1. investigating the creation or acquisition of an active trade or business, or 2. the actual creation of a new trade or business. However, distinguishing which costs should be classified start-up expenses can be a daunting task. Not only are the rules vague, but the various stages of the start-up process determine the tax classification of an expense. In any case, there will be many startup expenses before you even begin operating your business. It would be futile to hope to establish, operate, and succeed in setting up a business without adequate funding. It is important to estimate these expenses accurately and then to plan on how to raise the required capital. Often, first-time business owners fail to consider or greatly misjudge the amount of money needed to get their small business off the ground, and they fail to include a contingency amount to meet unforeseen expenses. Consequently, they fail to secure sufficient financing to carry their business through the period before it reaches its breakeven status and starts to make money. To avoid being “undercapitalized,” you will need to do adequate cost planning during your prelaunch phase. Most experts recommend that startup funding be adequate to cover operating expenses for six months to a year. At the very least you will need several months to find customers and get established. But to determine how much in financing to seek, you will need to develop detailed cost projections. Experts suggest a two-part process. First, develop an estimate of your one-time startup costs. Second, put together a projection of your overhead and operating expenses for at least the first six months of operation. Performing these two exercises will help to ensure that you put into place the necessary financial cushion to start and stay in business. Startup Cost Estimates Estimating the amount needed to start a new business requires a careful analysis of several factors. The first step is to put together a list of realistic expenses of one-time costs for opening your doors, including furniture, fixtures, and equipment needed. The list would also include the cost—down payment or |

|||

| 286 | Chapter 12 | ||

| cash price or, if purchased on an installment plan, the amount of each monthly or periodic payment. Record them in the costs table below. Down payment $_______ Amount of each payment $_______ The furniture, fixtures, and equipment required may include such things as desks, moveable partitions, storage shelves, file cabinets, tables, safe, special lighting, and signs. TYPICAL STARTUP COSTS ITEMS TO BE PAID ONLY ONCE: Furniture, fixtures, and equipment: Interior decorating $_______ Installation of fixtures and equipment $_______ Starting inventory $_______ Deposits with public utilities $_______ Legal and other professional fees $_______ Licenses and permits $_______ Advertising and opening promotion $_______ Advance on lease $_______ Other miscellaneous cash requirements $_______ TOTAL ESTIMATED CASH NEEDED TO START = $ Estimated monthly expenses: $_______Salary of owner-manager $_______Other salaries and wages $_______Payroll taxes and expense $_______Rent or lease $_______Advertising $_______Office supplies $_______Telephone $_______Other utilities $_______Insurance $_______Property taxes $_______Interest expense $_______Repairs and maintenance $_______Legal and accounting $_______Miscellaneous TOTAL ESTIMATED MONTHLY EXPENSES = $______Multiply by 4 (4 months) or 6 (six months) $______Add: total cash needed to start from above TOTAL ESTIMATED CASH NEEDED $______ |

|||

| Construction Business Environment | 287 | ||

|

Once the approximate amount of cash required to start the business is determined, you can then estimate how much money is actually available or can be made available to put into the business and to think about where the rest of the money needed to start the business will be coming from. Employees and Required Forms If you intend to hire yourself or others as a full- or part-time employee of the company, you may have to register with the appropriate state agencies or obtain workers’ compensation insurance or unemployment insurance (or both). When hiring employees, personnel files are needed for each person. At a minimum an I-9 form, an IRS form W-4, and the state equivalent form for employee income-tax withholding need to be included. Independent subcontractors should sign IRS form W-9. You may also require a copy of the contractor’s workers’ compensation insurance. Some state laws require subcontractors to be included on the firm’s policy. Utilities Utilities are necessary overhead expenses. Advance deposits are usually required when you sign up for power, gas, water, sewer, and phone services. Upon deciding to establish your own business, place a display ad in the telephone book’s Yellow Pages (or at least a listing). Expense Report It saves time to have a standardized expense report form for employees so that they can request reimbursement for their business expenses. Even if the contractor has just started doing business, it is imperative to monitor expenditure, and a standard form is perhaps the best way to do so. The expense report needs to be neatly typed and organized, identifying each location, project name and number, and applicable dates. Original receipts and supporting documentation should all be attached to the standard form. Accounting should then process and record it in a timely manner before filing. Office Equipment and Furniture All businesses need some equipment and furniture, although no two businesses will have identical needs. Sometimes it may be better to preserve cash for inventories or working capital and purchase good used fixtures and equipment at less expense. Phone and Internet Service Get a phone number and domain name (for your Internet website) for your new business. The domain name should be simple and easy to remember. This is discussed in greater detail in the a later section of this chapter. Suppliers Identify key suppliers by their names and addresses, type and amount of inventory furnished, credit and delivery policies, history and reliability. It may be prudent to have more than one supplier for crit- |

|||

| 288 | Chapter 12 | ||

|

ical items. Suppliers are often reluctant to ship their products to new businesses. This is one reason why you should get to know your banker and request credit references acceptable to most firms. You may have to pay your suppliers C.O.D. during the early phase of startup, so take this fact into account when preparing your financial planning and startup costs. Bookkeeping and Accounting Organize your accounting and record-keeping system and learn about the taxes the new company is responsible for paying. Company documents generally are required to be kept for 3 years, including a list of all owners and addresses, copies of all formation documents, financial statements, annual reports, and amendments or changes to the company. All tax and corporate Filings should be kept for at least three years. There is probably no reason why you cannot do your own record keeping, at least in getting started. If your bookkeeping capabilities are limited, use a part-time accountant to set up the company’s books on the basis of the above simple method. The accountant can keep the books for the first few months while you learn the general procedure. Let your accountant be your advisor. After a short time you will probably feel comfortable doing all the accounting without outside help. Miscellaneous Issues to Consider In the construction industry, equipment and machinery are often essential to your business. Without the proper equipment, it would be difficult to get jobs done efficiently and on time. The goal is typically to complete a project in accordance with plans and specifications, on time, within budget, and at the lowest possible cost. When starting a construction business, it is crucial to have the appropriate equipment to execute the types of construction projects anticipated. As in all businesses, it is important that the equipment pay for itself to earn a significant profit. In other words, the cost to own and operate the equipment should be less than what the contractor charges for its use. You will also want to consider both business and personal living expenses when determining how much cash you will need. If you are leaving a salaried job to start your business, you should include in your expense projection an estimate of your and your family’s living costs for the months it will take to build your business. Talk to family members about the minimum amount of money your household will need each month to function. Once you add up startup costs to your six-month tally of recurring costs, the total may amaze you and spur you to reconsider or to look for ways to economize. It probably makes sense to review certain categories, such as equipment, office supplies, or advertising/promotions, with cost control in mind. You’ve estimated your startup costs to the best of your ability, but chances are that you’ve never owned or operated a business before. It would probably be wise to discuss with an established or experienced business owner whether you’ve made the correct assumptions in projecting your costs. The U.S. Department of Commerce Minority Business Development Agency (www.mbda.gov) has articles that discuss how much money will be needed to start a business, including helpful checklists and referrals to other resources of information. The U.S. Small Business Administration (www.sba.gov) was created specifically to assist and counsel small businesses. |

|||

| Construction Business Environment 289 | ||

| 12.4 BUSINESS FORMS, TAXES, LICENSES, PERMITS, AND INSURANCE | ||

|

As a business owner you are obliged to understand and comply with government laws and regulations that apply to your business and are designed to protect you, your customer, and any employees. Having taken the decision to start a new business, you may now need to obtain a number of licenses and permits from federal, state, and local governments. Since licensing and permit requirements for small businesses can vary from one jurisdiction to another, it is important that you contact your state and local government to determine the specific obligations of your new business. For example, in California you would need to take the contracting license exam before you can become licensed. Name and Legal Structure At this point, a decision must be made on the proposed name and legal structure of the new business. There are advantages and disadvantages of each type of business structure. The structure chosen will depend on the needs of your business and will have a fundamental effect on how you do business. You basically have four choices when selecting a legal structure: sole proprietorship, partnership, limited-liability company (LLC), and corporation or S-corporation. An individual proprietorship is a business owned and operated by one person. It is the simplest form of business organization and the form of entity frequently used by small businesses at start-up. If you need additional capital or expertise, a partnership may be the best entity. You can always incorporate later if practical. The expense to incorporate a small business is nominal, but unless incorporating increases your chances of success or better protects your investment, there is not much benefit in forming a corporation. Even though there is limited liability as to your personal assets when obtaining outside financing or in the event funds are misused, you can still be personally liable. Before deciding consult with an attorney and check with your Secretary of State—almost all states now are online—look for the corporations division to find the form for either Articles of Incorporation (to form your own corporation) or Articles of Organization (to form a Limited Liability Company). Many entrepreneurs today prefer forming a LLC to incorporation, partly because it requires less paperwork to maintain. While waiting for the Secretary of State to send the charter, you should contact each of the city, county, and state tax departments. A limited-liability company is a new business entity that every entrepreneur should understand. It combines the best aspects of incorporation with the tax advantages of partnership without the red tape of either. This combination of benefits has never existed before in such a simple and effective way. Anyone starting a new business must separate his or her personal assets from his or her business ventures. A limited-liability company contains personal protection in its purest form. Licenses and Permits These refer to the various federal, state, and local licenses and permits you may need to acquire prior to opening for business. A basic business-operation license is a license granting the company the authority to do business in that city or county and should be issued from the city in which your business will operate or from the |

||

| 290 | Chapter 12 | ||

|

local county (if the business will be operated outside of any city’s limits). Most cities or counties require you to obtain a business license, even if you operate a home-based business. A federal employer-identification number (EIN), also called a tax-identification number, is required for almost all types of businesses. Note: your business may also need to acquire a similar tax-identification number from your state’s department of revenue or taxation. When you get your corporate charter (if a corporation), you must apply for a federal Employer Identification Number (EIN). To do so, first go to the IRS website, download Form SS-4, and fill it out. Then call toll-free (866) 816-2065 to get your EIN in 15 minutes or less. Once you get the EIN number, download Form 2553 (S-election, if you want to avoid double taxation on your company earnings) and fill it out. Be sure to sign as a shareholder in the middle of the page and as an officer at the bottom. If you choose to form a LLC, you will also need to decide how you want to be taxed (as a sole proprietorship, partnership, S-corporation, or C-corporation) and make that election on IRS Form 8832. A fictitious business name permit (also called “dba” or “doing business as” permit) is required for almost all types of businesses. To make the public better aware of just what your firm offers, it is generally good practice to choose a business name that describes your product or service. Apply for a fictitious business name with your state or county office when you plan on going into business under a name other than your own. The bank will require a certificate or resolution pertaining to your fictitious name at the time you apply for a bank account. Persons entering into certain kinds of business will have to obtain an occupational license through the state or local licensing agency. These businesses include building contractors, real-estate brokers, those in the engineering profession, electricians, plumbers, insurance agents, and many others. Often they have to pass state examinations before they can get these permits and conduct business. Contact your state government offices to get a complete list of occupations that require licensing. If you are planning to run your business from home, you should carefully investigate zoning ordinances. Residential neighborhoods tend to have strict zoning regulations preventing business use of the home. Even so, it’s possible to get a variance or conditional-use permit; and in many areas attitudes toward home-based businesses are becoming more supportive, making it easier to obtain a variance. Federal regulations control many kinds of interstate activities with license and permit requirements. In most cases, you won’t have to worry about this. However, a few types of businesses do require federal licensing, including investment advisory services. Tax Strategies Tax planning is a year-round event if you want to minimize your business tax bill. Whether it’s surviving an audit, capitalizing on business deductions, or finding tax-friendly ways to run your business, a good accountant can help reduce tax obligations and make paying taxes less anxiety-provoking. Once you have the federal EIN number, you will need to obtain ID numbers for state sales- and income-tax withholding and for the state unemployment tax. Complete the forms for the tax registrations that you obtained; add the federal EIN number and you can now mail in these state forms. Having the federal EIN number in hand also allows you to open a corporate checking account. If you are a sole proprietorship or partnership, you will have to file and pay federal estimated tax reports each quarter based on estimated annual income. Partnerships file an annual information return, and each partner’s share of profits is included in their individual personal income-tax return. Corporations must also file for estimated taxes. Maximize what you can deduct and discover what you can write off by knowing what constitute legitimate business expenses. |

|||

| Construction Business Environment | 291 | ||

| Insurance Insurance is an important prerequisite of any business. The premiums are usually expensive, especially business liability, but you cannot operate with peace of mind without full coverage. There are many types of insurance for businesses, but they are usually packaged as “general business insurance” or “business owner’s policy.” If you plan to offer your employees health insurance, talk to your agent about the up-front fee. Record the premium payment you will need to make before opening your business. Bank Account With the federal EIN number in hand, you can now open a corporate checking account. Get to know the manager of your bank. He will be one of your best references. Ask his or her advice on financial matters. The more he or she advises you, the better he or she will come to know you. Develop a line of credit so it will be there when you need it. The banks can’t exist without making loans, so don’t hesitate to apply. Get set up with American Express, Visa, or any other credit cards you will accept for payment and use for expenses. It will cost you from 3 to 5 percent, but it is necessary for attracting customers and entertaining. To establish your bank account, you will need a Federal ID number or Social Security number along with your certificate of assumed (fictitious) business name. If you are incorporated, the bank will want a copy of the minutes and a corporate resolution authorizing the account. Contact the bank prior to opening the account to see what their specific requirements are for opening a business checking account. 12.5 CREATING A PROFESSIONAL IMAGE |

|||

|

Owning your own business is one of the better ways to gain wealth and personal satisfaction, provided you know what is required. Starting a business is risky, but your chances for making good increase if you understand the challenges you will face and work out as many of them as possible before commencement. Develop a Business Identity It is imperative to create a good corporate image and business identity that reflect confidence and efficiency. One of the first things to organize is a professionally designed logo, business card, letterhead, and promotional material for the business. A professionally created logo and letterhead can go a long way to giving clients the desired image. Advertising and Promotion Many new businesses start operating with a grand opening announcement, giving press releases to local papers and relevant business publications. It may also be prudent to print out a few hundred circulars to distribute to potential clients. Alternatively, grand-opening circulars can be placed in the newspaper to be distributed to subscribers. In any case, the dollar cost of any planned advertising and marketing initiative to announce the launch of the new business should be recorded and should include the cost of flyers, sales letters, phone calls, signs, brochures, and other promotional items. |

|||

| 292 | Chapter 12 | ||

|

|||

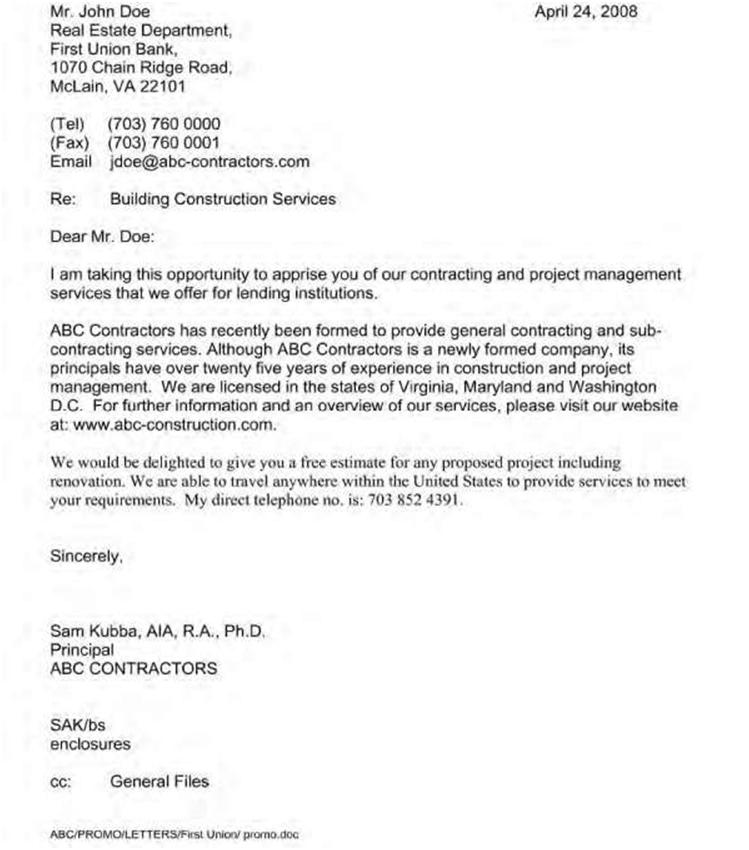

| Figure 12.1 An example of a typical promotional letter that can be sent to clients to inform them that your company is ready for business. Promotional material should accompany the letter. | |||

| Construction Business Environment | 293 | ||

| Marketing Yourself Develop professionally designed brochures and other marketing materials. As you are essentially selling a special service, be sure to know how to market it. A marketing plan and strategy are necessary for services that target your ideal customer. Now that you’ve set up the company for success, you need to get the word out. Figure 12.1 shows a typical marketing letter to let customers and potential clients know you are ready for business. Time Management A secretary/office manager could help make the operational aspect of the business as efficient as possible to allow you to concentrate on managing and growing the business. This will free you from having to process orders, pay bills, pay employees, pay taxes, maintain your permits, etc. The more organized you are, the more efficient you are. |

|||

| 12.6 SELLING YOURSELF | |||

|

Professional performance means much more than doing your job effectively. The way you conduct yourself in a business environment not only reflects your position within a company but impacts your chances for career growth. Many people are unsure of the proper protocol for various situations in a business setting. Most potential clients can decide within minutes whether to trust you or your employees. Trust is pivotal in establishing relationships that can ultimately lead to business partnerships. Awkward introductions, weak handshakes, poor communication, ineffective meetings, and lack of consideration can negatively affect your career and business relationships. When all else is equal, good manners can be your greatest strength. Correspondence Correspondence is a tricky subject since there are numerous ways to communicate today. The decision to communicate with a client via telephone, email, or face-to-face depends largely on one’s personality. Introverts tend to prefer email because it is efficient and avoids direct contact; extroverts on the other hand prefer direct communication. Confidence If you are confident, you will appear as an accomplished professional to others. Confidence is attained by being organized and prepared and having the necessary knowledge to execute the job successfully. Being confident doesn’t mean never asking questions or succumbing to challenges. Paradoxically, confident people know the importance of questions. Remember to be cool, calm, and collected, and, above all else, think before you speak. Whether you are entering a new work environment or attempting to reinvent yourself professionally, know that you can do it. The corporate world can be rough, but with the aforementioned skills you are already on a path for success. |

|||

| 294 | Chapter 12 | ||

| Meetings Meetings are an area where success is largely dependent upon good organization and adequate preparation. You will often meet people who are busy and usually inaccessible to you. Compile questions you want to ask or topics you want to cover and know in advance what you hope to accomplish. Business meetings are one arena in which poor etiquette can have negative effects. By improving your business-meeting etiquette you automatically improve your chances of success. Comfort, trust, attentive-ness, and clear communication are examples of the positive results of demonstrating good etiquette. Informal meetings are generally more relaxed affairs and may not necessarily take place in the office or meeting room. Even so, a sense of professionalism and good business etiquette are still required. The business etiquette of formal meetings such as departmental meetings, management meetings, board meetings, negotiations, and the like can be perplexing. Such meetings usually have a set format. A summary of business etiquette guidelines for formal meeting include: Go prepared to the meeting as your contribution may be fundamental to the proceedings. If you are using statistics, reports or other information, hand out copies prior to the meeting with ample time to be studied. Mobile phones should be switched off during the meeting. Arrive on time and appropriately dressed as this reflects professionalism. Where an established seating pattern exists, accept it. If you are unsure, ask. It is courteous to begin introductions or opening remarks with a brief recognition of the chair and other participants. When discussions are under way it is good business etiquette to allow more senior participants to contribute first. Interrupting a speaker reflects bad manners – even if you strongly disagree. Note what has been said and return to it later with the chair’s permission. When speaking, be brief and to the point and ensure that what you say is relevant. It is a breach of business etiquette to divulge information to others about a meeting. What has been discussed should be considered as confidential. 12.7 IDENTIFY AND TRACK SOURCES FOR LEADS |

|||

|

There are many methods to identify and track potential sources and project leads, depending on whether your business is a one-person organization or a well-organized firm with several employees. These methods include: 1. Send out flyers, brochures, emails, etc., to potential clients as an excellent start point. 2. Scan the Internet. Typically many of today’s contractors and subcontractors have websites, and some of these firms have client lists (to build up potential customer confidence) on their websites. These lists can be researched to see which if any names are worth following up on. 3. Visit the various neighborhood commercial-real-estate agents to see which commercial properties are on the market. A list of all these possible leads should be made and followed up with letters and brochures offering the company’s services. |

|||

| Construction Business Environment | 295 | ||

|

4. Since many of the clients will be property owners, developers/investors, and lenders (e.g., banks, lending institutions), it would be prudent to make a list from the Yellow Pages, internet, and research in the public library. |

|||

| 12.8 BIDS, CONTRACTS, AND PAYMENTS | |||

|

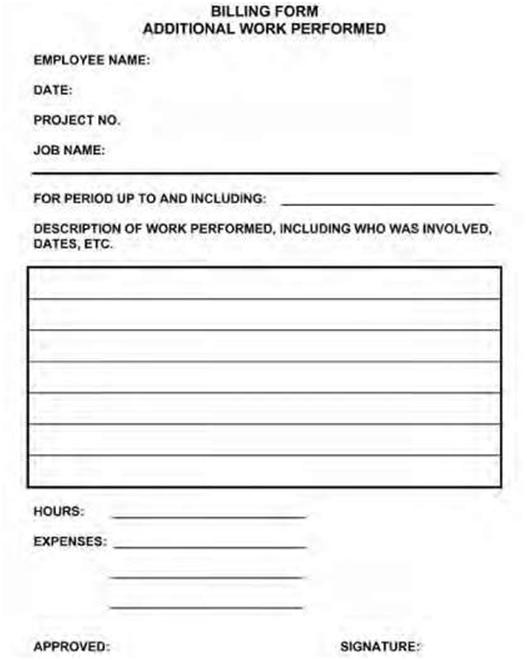

Construction jobs are usually awarded on the basis of a bid or by negotiation. The contractor will essentially estimate the cost to execute the project and then add a certain percentage for profit and contingencies. But in the final analysis, your rates should be set by the logic of most businesses—i.e., it should reflect what the market will bear. In any case, ensure that you read the contract thoroughly. Many contractors and subcontractors often sign prepared contracts without adequately reading them or having an attorney review them. Many contractors are uncomfortable in dealing with the paperwork associated with the job. But, unfortunately, contracting is about contracts, and contracts include paperwork! As much as 50 percent of all profits made or lost on construction projects can be a result of managing the contract properly. Assembling all the required documentation, change-order requests, notices, and information required by your contract may seem overwhelming. But once you get in the habit of following the contract, it will become a normal part of your construction methodology. In order to receive all you deserve while building a project for your customer, you must be timely in your requests. Missing the notice time requirements may result in a loss of your right to collect for items out of your scope of work or control. It would be wise to take a little extra time to be complete in your description of the event. Issues in question should be supported by photographs when necessary. By not documenting conflicts or changes in a timely and complete manner, contractors inadvertently shift more responsibility onto their own shoulders, which may cost them their right to collect. It is customary to visit the site beforehand (at no cost to the client) to obtain the information needed for preparing and submitting an estimate. This in turn helps to avoid surprises down the road, since the client already knows what to expect up front. When additional work is required, a separate invoice should be presented (Figure 12.2). Do not hesitate to get rates from other builders and compare them with your own, bearing in mind the supply and demand in your area. |

|||

| 12.9 THE INTERNET, THE WEBSITE, AND FORMING AN ENTITY | |||

|

The Internet has created enormous opportunities to reach previously unimaginable numbers of people. In addition to making communication possible to more people than through print advertising and other media, it also makes it available to people who might not otherwise have access. A website for a small business or any size company, has become a high priority; not only is it a great marketing tool, but it allows you to develop your services and launch multiple marketing campaigns in a short period of time. Consider your website a platform to feature your services to your customers and the world. But using the Internet is more than just creating a website and waiting for potential clients to find it. The website should be only one part of an overall Internet marketing strategy. And even before setting up a website, it is imperative to have email service in place. |

|||

| 296 | Chapter 12 | ||

|

|||

| Figure 12.2 Typical form for additional work done. | |||

| Email Service Email service is a high priority for communication and for sending promotional material. A growing number of clients consider email availability vital and find it burdensome and inefficient to communicate by posted mail. An email address should be professional and simple. Once a website is established, the email should reflect the domain name of the site. |

|||

| Construction Business Environment | 297 | ||

| The Website The public increasingly expects a professional to have a website, just as he or she is expected to have a business card. But first it is important to understand why a website is necessary and what can be achieved from it. At a minimum, a website can market your services to a global audience. Additionally, it is an excellent vehicle to sell the company’s services over the Internet. Remember to consider what information you want prospects to gather from visiting your website. A well designed website can typically be used to: Attract enquiries from potential customers Provide better service to customers Provide more information about the firm and its services Obtain feedback from customers on the company’s services Recruit staff Improve efficiency Using your website to provide a user with better access to your company can reap great benefits. Clients are happier and receive resolutions to problems quickly, and you can devote more of your time to other critical issues. The list of services you can offer via your website is enormous. For example, it can include project facts and figures, including projects recently executed, company experience, etc. It can also include clarification regarding your firm’s structure—who does what. The site can be used to draw attention to upcoming events or time-sensitive information. Plan Your Approach The Internet and your website are just another link to your target audience. You have already been implementing all the necessary steps you need to in your day-to-day business. You now need to translate this to the new medium. Think about the image you want to convey to site visitors, and make sure everything on your site contributes something toward that image. Developing and maintaining a website is no small accomplishment. But whether you are creating a concept for your website for the very first time or trying to update a current site, make sure you look at your site from the user’s point of view. For example, what will site visitors want to know when they log on? If you’re working with an existing site, ask clients and prospects what they think of the information offered there. What else would they like to see featured on the site? Know your visitors (or future visitors) and what they want and need. If you’re starting from scratch, a quick survey may help determine the answers to these questions. Check out other builder/contracting websites to discover additional services that your peers are providing to users. For each of the objectives you have set for the company website and yourself, you need to decide: Who is the target audience? What are you trying to get them to do or obtain from your site? What do you need to have on your site to attract prospects to the site in the first place and to come back again? Website content and design are both vital for market success. What services do you need to provide on- or off-line to back up your “promise” to your visitors? How are you going to promote your website and contents to your target audience? |

|||

| 298 | Chapter 12 | ||

| Setting Up the Website To set up an acceptable commercial website (as opposed to a personal home page) you need the following: A domain name, such as www.mysite.com Web space—a home for your website’s files, provided by a hosting company The website itself—a collection of pages and images, linked together to make a complete site First, a web address or domain name is needed. There are scores of companies such as www.reg-ister.com and www.dotster.com that let you check that the name desired is available and, if so, register the domain name online. Domain registration is not expensive, and often the domain name will be registered with the same hosting company that provides the web space. Most companies will “park” your name until your website is ready. Web space is space on a computer owned by a hosting company. It is set up so that anyone who types your domain name into their browser will be connected to your site. There are numerous hosting companies, but some research is needed on the Internet to find one that best serves your needs. Anyone can put a website together, and it seems that just about everyone does, with greater or lesser success. If you can use a word processor, you can create a website. However, creating a good website is an entirely different matter and requires a lot of thinking and details. Website Components and Details The website should articulate the services offered. This may be outlined in a mission or vision statement. When you are starting out on the Internet, you are starting with something close to a clean sheet. The majority of Internet users probably won’t actually know who you are. You can project any kind of image that you wish, and, moreover, you can emphasize any particular aspect of the organization that you wish to. Sit down with some colleagues and some paper and brainstorm until you come up with a series of points that match your organization and what you do or wish to do. Next, you need to match these points to the kind of image you want to portray on your site. Consequently, when it comes time to actually put the site together, you can ignore the flashy graphics and animations and concentrate on guiding the user quickly and effectively to the information that they need. Use your site to display your particular abilities to their best advantage; in other words, play to your strengths. Corporate image comes into play here as well. You will probably want to make sure that the image on the web pages matches that of the image displayed in other formats and media. However, don’t forget that you are starting from scratch, so you have a free hand. It might actually make sense to have some subtle changes on the website; if your corporate color is blue, think about changing to another shade or be radical and go for red! Decide on a theme and stick to it. Use the same logo on your pages, in the same position, in the same size. Today, it is easier than ever to create a website; you can even do it overnight. With a wealth of tools and options available on the web today, you don’t need to be a graphic designer or web developer to capture the basics. Templates are a great way to get started in developing your own website, and you can choose from a variety of simple but attractive designs. There’s always room to upgrade, and it’s easier than ever to find a unique template so you’re not simply imitating another site. No coding is involved— you don’t even need to learn HTML. It is illegal to copy another company’s web page, but tracking down a free template is simple: just download it from the internet, and you’ll have the framework ready to go. Once you’ve found the right |

|||

| Construction Business Environment | 299 | ||

|

match, take a look at your options for upgrading and customizing it. Not everyone needs a customized website; if you’re looking for standard functions and presentation, you’ll find plenty of attractive options on the Internet. After installing the templates using your favorite website builder, you can immediately publish to the web. Figure 12.3 shows an example of a template design that has been modified and that you can find on the Internet. These websites offer free web templates as well as design services. The button links may be on the top or on the left side of the page. Both easily take you to where you want to go (e.g., to the mission statement, jobs in progress, services offered, etc.). It is largely a matter of preference as to how the page is composed and designed. However, for a professional-looking website it is strongly recommended to use a professional for its design. Who do you want to visit your site? This depends very much on the answers that you have already come up with. Existing customers and clients, potential customers, people interested in your subject area who may never have heard of you, organizations, individuals, groups, and so on. If you are a building firm, your groups might look a little like this: |

|||

|

|||

| Figure 12.3 Example of a sample home-page template, which can be freely downloaded from the Internet from sites such as www.freewebsitetemplates.com or www.steves-templates.com. This template has been modified to suit a contracting business (based on a www.freewebsitetemplates.com template). |

|||

| 300 | Chapter 12 | ||

| Property owners and facility managers Lenders Investors Architects and engineers Create your list and then prioritize it. For example, if you want to promote an image of a contracting firm that specializes in electrical work, property owners may well take higher priority than casual users. This should be emphasized in the structure of the site’s pages and the weighting that you give to it on the home page. To let users know you are to be trusted, remember what was mentioned earlier—you cannot take it on trust that your viewer knows who you are. The message must be hammered home at every opportunity. Use your company logo, university crest, and so on to reinforce this. If you have won an award, make sure everyone who visits knows this! Your viewers need to be reassured that your firm is to be trusted and that its information is reliable. This must be emphasized on every single page that you publish—there is no telling which page a user will go to first, so be consistent in the positioning of your logo and place it on every page. You’ve got less than 15 seconds to make an impact before your visitors leave. You have to work very hard in this small window of opportunity. Make it quite clear what your message is. If you don’t know, your viewers won’t. Design is vital. Give them enough guidance to let them work their own way(s) through your site. There has to be a reason for people to come and look at your website and a reason for them to keep coming back. You need to offer something of value such as a detailed list of your services with current prices. However, if you can think of some valuable free service (such as free estimates) that you can offer to bring people to your website, they are likely to browse around once they are there. A successful website is not necessarily an attractive one or one full of the latest web technology. It is not even usually dependent upon how many people visit it. Rather, it is how many come back time and time again and how much business it generates. Your site is up and you are waiting for the inquiries to come in, but they don’t, because no one knows your site is out there. The site must be publicized. Potential customers need to know the website exists. All letterheads, brochures, cards, and advertising should mention the website address and email address. Submit your site to all the search engines. Generally speaking, it takes at least a few months for a website to become recognized and start to generate responses. That’s how long it usually takes the big search engines, especially Google, to index a new site. Also make sure that any expert directories you are listed in are linked to the site. Of course, the popularity of your site and the speed at which it becomes popular really depend on what is being offered and how it is promoted. |

|||