There are several reasons a contractor should establish a formal cost accounting system, both at the home office and at the jobsite. Four of the more prominent ones include:

- Prepare financial statements for internal and external use;

- Process cash-in (revenue) and cash-out (expenditures);

- Prepare and file taxes as required by the Federal Government as well as some state and local jurisdictions;

- Manage the internal financial affairs of the company

- Are we making money?

- Are we returning an adequate return on equity (ROE) to our investors?

- Are we focusing on the proper type of work? Is our company operating in the proper market?

- How are our people performing?

Consistency is important for cost accounting and financial management for contractors. Their financial reporting tools must be consistent from year to year, from project to project, and from month to month within each project. In order to report costs and projected profits consistently, contractors must have reliable financial management systems in place, particularly as it relates to cost control.

Cost control in construction is an important topic and is discussed in detail in several chapters of this book. It is important to distinguish between cost reporting and cost control, especially as it relates to jobsite cost accounting. The foremost question to ask is:

Can the jobsite team really control costs or are they simply just reporting costs? And can they really ‘control’ the operations of the construction craftsmen in the field, or are they doing their best to ‘manage’ the process so that the craftsmen can achieve the estimate?

Most construction management and cost accounting textbooks focus their cost control discussion simply on cost reporting. But if timely modifications and corrections are not made to the processes, the jobsite management team is not properly managing costs and cannot achieve the bottom-line fee, let alone improve it. To have an effective cost control system the construction project team must follow some basic rules:

- Cost reporting data has to be timely and accurate. If actual cost data was not input to the accounting system accurately, then the results will be of no value to the jobsite team.

- Eighty percent of the costs and risk on a project fall within 20% of the construction activities – this is known as the Pareto 80-20 rule. The jobsite team should focus on the riskiest activities. The 80-20 rule is expanded on throughout this discussion of financial management.

- The original estimate and schedule should be shared with the contractor’s field supervision, including superintendents and foremen. In order for them to plan and implement the work they need to have been given the complete picture.

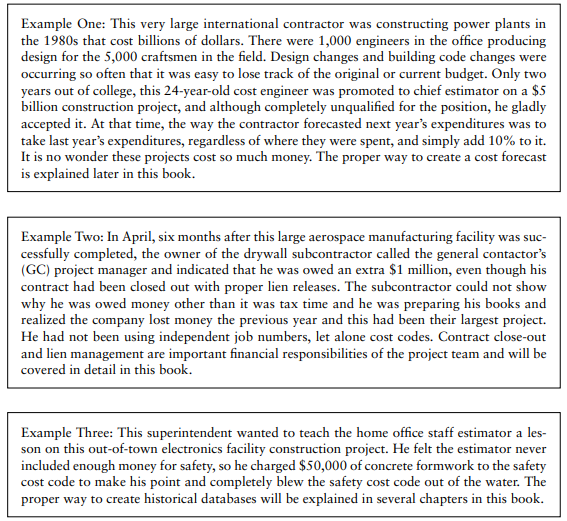

There are many bad examples of construction cost accounting, especially as it relates to cost control. We will be sharing some of these throughout the text. There are a few good ones sprinkled in as well. Here are a couple of examples to get you started: